BYTE BLOG

BUILDING BLOGS BY THE BYTE

BYTE BLOGGING WORLD

TECH BLOG

AI: HYPE VS REALITY

What are the current trends for practical AI? May 2, 2024

MACHINE LEARNING HYPE MODELS MAKING MONEY

Artificial Intelligence (AI) is reshaping the landscape of business operations, offering a myriad of practical applications that drive efficiency, innovation, and competitive advantage. One prominent area where AI demonstrates its value is in customer relationship management (CRM). AI-powered chatbots and virtual assistants provide round-the-clock support, responding to customer inquiries promptly and accurately. These automated systems not only enhance customer satisfaction by delivering personalized interactions but also alleviate the burden on human agents, allowing them to focus on more complex tasks. Moreover, AI analytics revolutionize market research and customer segmentation by analyzing vast datasets to identify trends, preferences, and purchasing behaviors, enabling companies to tailor products and services to specific demographics with precision.

Supply chain management represents another domain where AI excels in optimizing business operations. AI algorithms leverage historical data and real-time inputs to forecast demand, anticipate supply chain disruptions, and optimize inventory levels. By automating these processes, companies can minimize stockouts, reduce carrying costs, and enhance overall efficiency throughout the supply chain. Furthermore, AI-driven predictive maintenance solutions enable proactive equipment monitoring and fault detection, minimizing downtime and maximizing asset utilization. This proactive approach not only reduces maintenance costs but also enhances operational reliability, ensuring seamless production and delivery processes.

In addition to enhancing operational efficiency, AI empowers businesses to unlock new revenue streams through innovative product development and marketing strategies. AI-powered recommendation engines analyze user behavior and preferences to deliver personalized product recommendations, driving sales and fostering customer loyalty. Moreover, AI-driven content generation tools streamline marketing efforts by automating content creation, optimization, and distribution across multiple channels. By leveraging AI in these strategic areas, businesses can gain a competitive edge in the market, capitalize on emerging opportunities, and adapt to evolving consumer demands with agility and precision.

Amidst the excitement surrounding AI's potential, many companies fall prey to the allure of "snake oil" products that overpromise and underdeliver. One common pitfall is the oversimplification of AI capabilities, leading to inflated expectations and disappointment when solutions fail to meet business needs. Moreover, the lack of industry standards and regulation fosters a climate where companies peddle AI solutions without adequate transparency or accountability. This "black box" approach not only hampers trust but also exposes businesses to ethical and legal risks.

Furthermore, the commodification of AI exacerbates the issue, as vendors prioritize sales over genuine innovation, flooding the market with generic solutions that offer little differentiation or tangible value. This "AI-washing" phenomenon perpetuates the myth of AI as a panacea, diverting resources from more meaningful investments in research and development. Moreover, the hype surrounding AI fuels a culture of fear and misinformation, where companies rush to adopt AI technologies without fully understanding their implications or limitations. As a result, instead of realizing the transformative potential of AI, businesses find themselves entangled in a web of false promises and empty marketing rhetoric.

BITCOIN ETF'S

The volatility of crypto in your retirement portfolio might break the bank April 2, 2024

BTC TO YOUR RETIREMENT A SLIPPERY SLOPE

The integration of Bitcoin Exchange-Traded Funds (ETFs) into retirement accounts and pensions raises concerns beyond volatility, including the concentration of Bitcoin ownership, the risk of loss, and technological inefficiencies. Bitcoin's decentralized nature, while celebrated for its resistance to censorship and control by centralized authorities, also means that a significant portion of the currency is controlled by a relatively small number of wallets. This concentration of ownership introduces systemic risk, as the actions of a few large holders can have outsized impacts on the market, potentially leading to price manipulation and increased volatility.

Moreover, the risk of losing Bitcoin due to various factors adds another layer of complexity to its integration into retirement accounts and pensions. Unlike traditional assets such as stocks or bonds, Bitcoin cannot be recovered if lost or stolen, whether due to hacking, forgotten passwords, or other mishaps. The irreversible nature of Bitcoin transactions means that once funds are sent to an incorrect address or lost due to technical failures, they are gone forever. This risk of permanent loss underscores the need for robust security measures and diligent custodial practices when managing Bitcoin holdings within retirement portfolios.

Furthermore, Bitcoin's technological limitations, including its slow transaction processing speed and outdated proof-of-work consensus mechanism, pose challenges to its widespread adoption as a viable currency and investment asset. The Bitcoin network's scalability issues result in slow transaction confirmation times and high fees during periods of network congestion, hindering its usability for everyday transactions and limiting its utility as a medium of exchange. Additionally, the energy-intensive nature of Bitcoin mining, which relies on proof-of-work consensus to validate transactions and secure the network, has come under scrutiny for its environmental impact and inefficiency compared to newer, more energy-efficient consensus mechanisms such as proof of stake.

In contrast to Bitcoin's proof-of-work model, which requires miners to perform complex cryptographic calculations to validate transactions and earn rewards, proof-of-stake algorithms offer a more energy-efficient and scalable approach to consensus. Proof-of-stake protocols select validators to create new blocks and secure the network based on their stake or ownership of the cryptocurrency, rather than their computational power. This shift towards proof-of-stake consensus mechanisms reflects a broader trend in the cryptocurrency space towards sustainability and efficiency, as developers seek to address the scalability and environmental concerns associated with legacy blockchain technologies like Bitcoin.

Overall, while Bitcoin ETFs offer investors exposure to the potential upside of the cryptocurrency market, they also introduce additional risks and considerations beyond price volatility. From the concentration of ownership and risk of loss to technological inefficiencies and environmental concerns, the integration of Bitcoin into retirement accounts and pensions requires careful evaluation of both the opportunities and challenges posed by this emerging asset class. As the cryptocurrency landscape continues to evolve, investors and fund managers must stay informed and adapt their strategies accordingly to navigate the complexities of this rapidly changing market.

TOO MANY FRAMEWORKS, NOT ENOUGH PROBLEMS?

Focus on learn how things work when you remove the layers of software abstractions being used to develop March 2, 2024

The Proliferation of JavaScript Frameworks: A Double-Edged Sword

The world of software development, particularly in web applications, has witnessed an explosion of JavaScript frameworks in recent years. While these frameworks offer developers powerful tools and libraries to streamline development processes, the sheer abundance of options has led to concerns about fragmentation, complexity, and performance limitations. Unlike statically typed languages, JavaScript's dynamic typing and interpreted nature introduce challenges in terms of reliability, maintainability, and performance optimization, especially as applications scale in size and complexity.

One of the primary criticisms leveled against JavaScript is its lack of static typing, which can lead to errors and bugs that are only discovered at runtime. Unlike languages such as Java or C++, where types are explicitly declared and enforced by the compiler, JavaScript's loose typing system allows for flexibility but also increases the likelihood of runtime errors, making codebases harder to maintain and debug. Additionally, the absence of compile-time type checking hampers refactoring efforts and inhibits the development of robust tooling and IDE support, further complicating the development process.

Moreover, JavaScript's performance shortcomings compared to compiled languages like C++ or Java have become increasingly apparent as web applications grow in complexity and scale. JavaScript's interpreted execution model and lack of low-level optimizations result in slower execution speeds and higher memory consumption, particularly in computationally intensive tasks or real-time applications. While advancements in browser technology and JavaScript engines have improved performance over the years, JavaScript still lags behind native languages in terms of raw computational power and efficiency.

Furthermore, the evolution of JavaScript's role in software development has outpaced its original purpose as a client-side DOM manipulator. With the advent of Node.js and server-side JavaScript frameworks like Express.js, JavaScript has expanded its domain to encompass full-stack development, including server-side logic, database interactions, and API integrations. While this versatility has led to increased adoption and developer productivity, it has also resulted in a proliferation of frameworks and libraries, each with its own conventions, paradigms, and learning curves.

In conclusion, while JavaScript frameworks have democratized web development and empowered developers to build rich, interactive applications, they also present challenges in terms of complexity, performance, and maintainability. The absence of static typing and the inherent limitations of JavaScript's execution model necessitate careful consideration and trade-offs when selecting frameworks and designing architectures. As the JavaScript ecosystem continues to evolve, developers must prioritize simplicity, performance, and compatibility to ensure the long-term sustainability and success of their projects.

MISTY

I am here to share my opinions on current technological trends based on my experiences as a Software Engineer for the past decade.

Based in Los Angeles :)

RECENT POSTS

-

30 UNDER 30 FRAUD

30 UNDER 30 FRAUD

SAM BANKMAN FRIED: ARRESTED -

THE FUTURE OF TODAY

THE FUTURE OF TODAY

BOSTON DYNAMICS: TERMINATOR? -

HOPE FOR TOMORROW

HOPE FOR TOMORROW

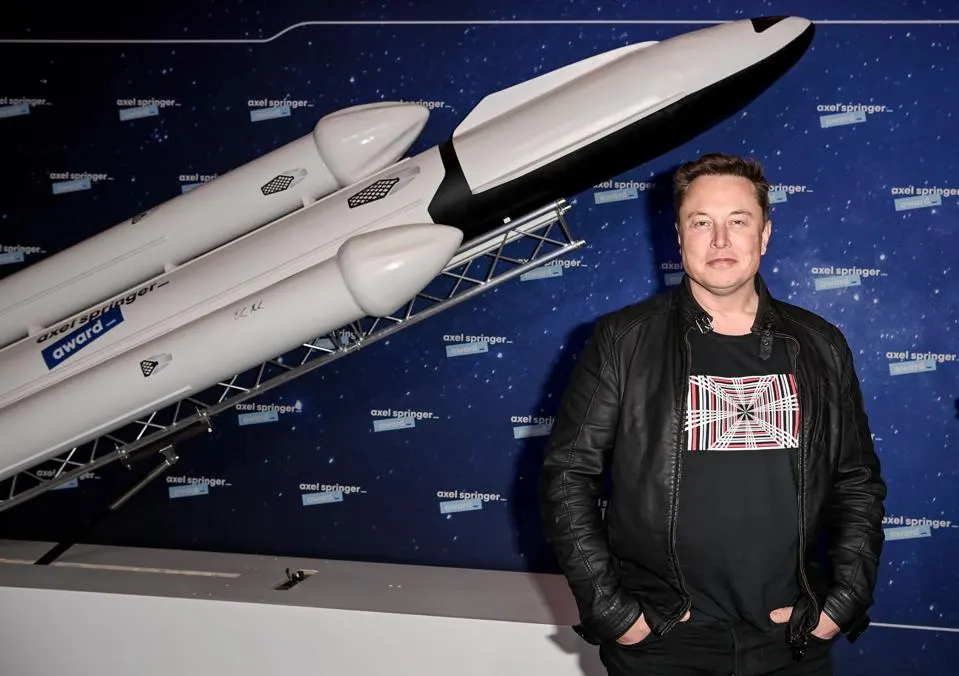

SPACE X: MARS OR BUST?

TAGS

PROOF OF STAKE AI CRYPTO PROGRAMMING SOFTWARE OS FULLSTACK UI / UX NEURAL NETWORKS ASSEMBLY LANGUAGE DEVOPS MACHINE LEARNING APPLE QUANTUM COMPUTING LINUX WEB 3

STAY IN TOUCH

Get post notifications or get in contact with Misty :)

CRYPTO TRENDING